Paying your Pimpri Chinchwad Municipal Corporation (PCMC) pcmc property tax has become easier than ever, thanks to the online payment system. In this guide, we’ll cover everything you need to know — from the payment process to calculating tax, helpline numbers, money-saving tips, and official PCMC tax office details.

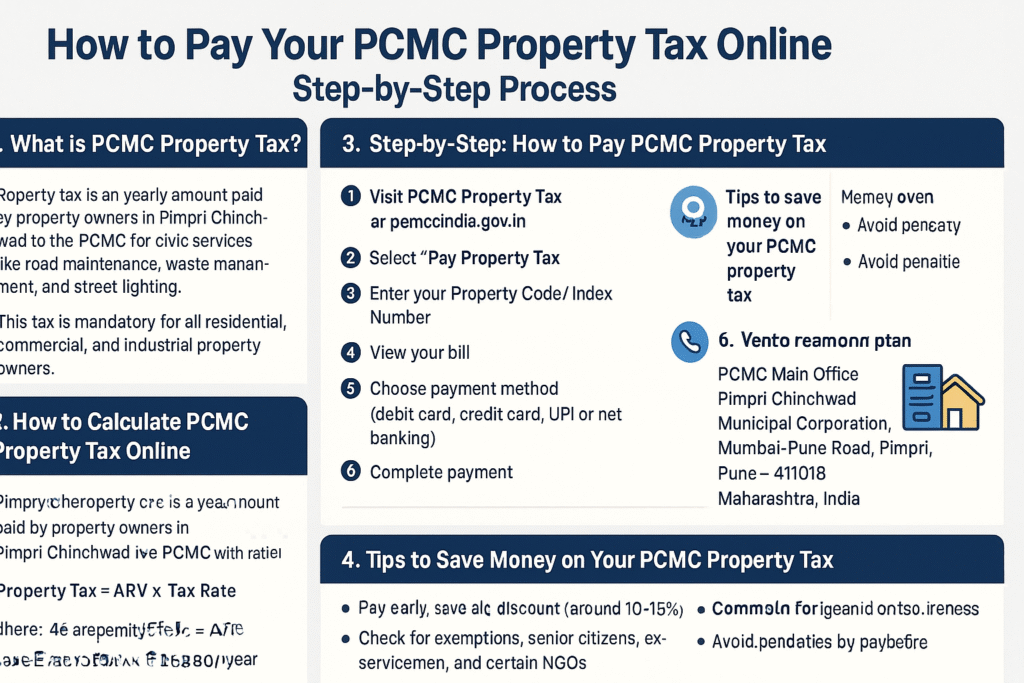

1. What is PCMC Property Tax?

Property tax is a yearly amount paid by property owners in Pimpri Chinchwad to the PCMC for civic services like road maintenance, waste management, and street lighting. This tax is mandatory for all residential, commercial, and industrial property owners.

2. How to Calculate PCMC Property Tax

The PCMC uses the Annual Rateable Value (ARV) method for calculation. The formula is:

Property Tax = ARV × Tax Rate

Where:

- ARV (Annual Rateable Value) depends on the property’s area, usage type, construction type, and location.

- Tax Rate is set by PCMC and differs for residential, commercial, and industrial properties.

Example:

If your property’s ARV is ₹20,000 and the tax rate is 38%,

Property Tax = ₹20,000 × 0.38 = ₹7,600/year.

You can also check the exact amount using PCMC’s online Tax Calculator available on their official website.

3. Step-by-Step: How to Pay PCMC Property Tax Online

- Visit the Official Website

Go to PCMC Property Tax Portal. - Select “Pay Property Tax”

Find the property tax payment option on the homepage. - Enter Your Details

- Enter your Property Code / Index Number (available on your previous bill).

- View Your Bill

The system will display your property details and pending tax amount. - Choose Payment Method

Options include debit card, credit card, UPI, or net banking. - Complete Payment

After payment, download the receipt for your records.

4. Tips to Save Money on Your PCMC Property Tax

- Pay Early: PCMC often gives a discount (around 10-15%) for early payments.

- Check for Exemptions: Senior citizens, ex-servicemen, and certain NGOs may get rebates.

- Verify Property Details: Ensure property size, usage type, and construction details are accurate to avoid overcharging.

- Avoid Penalties: Pay before the due date to avoid fines and interest charges.

5. PCMC Property Tax Helpline Numbers

- Helpline: 020-67333333 / 8888006666

- Email: tax@pcmcindia.gov.in

6. PCMC Tax Office Address

PCMC Main Office

Pimpri Chinchwad Municipal Corporation,

Mumbai-Pune Road, Pimpri,

Pune – 411018, Maharashtra, India.