If you live in PCMC, paying your property tax on time is not only a legal responsibility but also a way to contribute to the city’s development. In this guide, we’ll explain the PCMC property tax process, how to check and pay it online, important due dates, penalties, and PCMC helpline numbers with office addresses.

What is PCMC? – Full Form & Overview

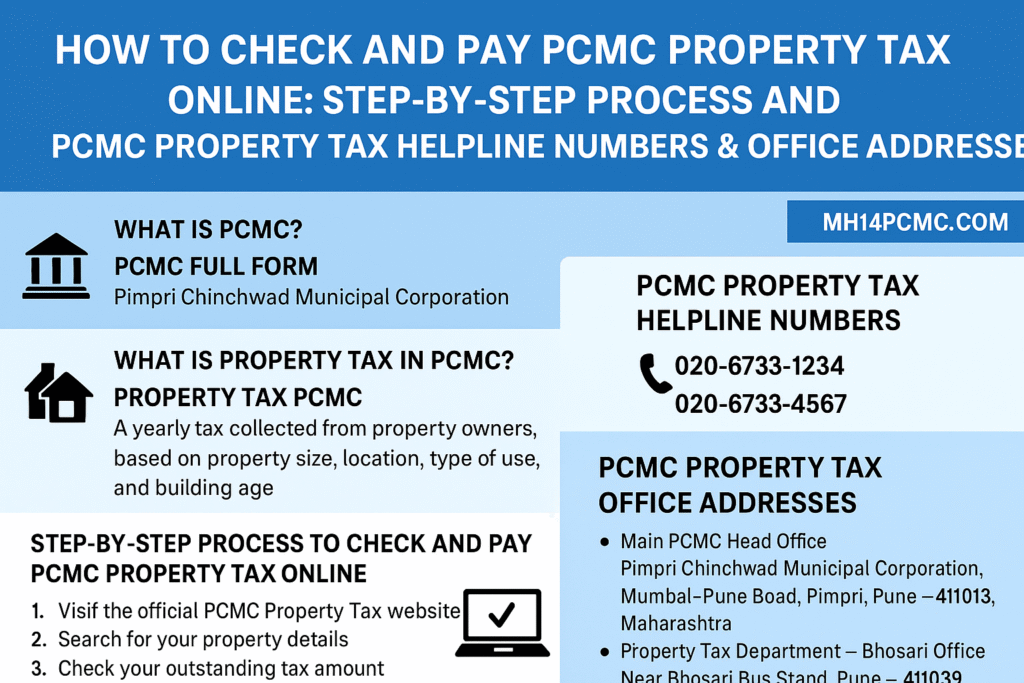

The PCMC full form is Pimpri Chinchwad Municipal Corporation. It is the civic body responsible for managing municipal services in Pimpri-Chinchwad, a fast-growing city in Maharashtra. PCMC handles public infrastructure, waste management, water supply, road maintenance, and tax collection, including property tax and the PCMC water bill.

What is Property Tax in PCMC?

Property tax PCMC is a yearly tax collected from property owners on their residential, commercial, or industrial property. The amount is calculated based on factors like property size, location, type of use, and building age.

This tax helps fund city development projects, roads, streetlights, drainage systems, and other civic services.

Benefits of Paying PCMC Property Tax Online

- 24/7 Access – No need to visit the office; pay anytime, anywhere.

- Quick and Secure – Avoid long queues and paperwork.

- Instant Receipt – Get payment confirmation immediately.

- Easy Record Keeping – Access previous payment history easily.

Step-by-Step Process to Check and Pay PCMC Property Tax Online

Follow these steps to check and pay your PCMC property tax online:

Step 1: Visit the Official PCMC Property Tax Website

- Go to the official Pimpri Chinchwad Municipal Corporation tax portal: https://www.pcmcindia.gov.in

- Look for the “Property Tax” section.

Step 2: Search for Your Property Details

- Enter your Property Code, Owner Name, or Old PT Code.

- Click on Search to view your property tax details.

Step 3: Check Your Outstanding Tax Amount

- The system will show your property details, the total tax due, and the payment history.

- Verify details before proceeding.

Step 4: Make the Payment

- Select the payment method: Debit Card, Credit Card, Net Banking, or UPI.

- Complete the payment process.

Step 5: Download Your Payment Receipt

- Save or print the receipt for future reference.

💡 Pro Tip: Pay before the due date to avoid penalties. PCMC often offers early payment discounts.

PCMC Property Tax Due Dates & Penalties

- Due Date: Usually by 31st May every year.

- Penalty for Late Payment: 2% per month on the outstanding amount.

PCMC Property Tax Helpline Numbers

If you have issues while paying your property tax PCMC or PCMC water bill, you can contact the official helplines:

📞 PCMC Property Tax Helpline: 020-6733-1234 / 020-6733-4567

📞 Water Bill Helpline: 020-6733-6789

PCMC Property Tax Office Addresses

You can also visit PCMC offices for offline payment or queries:

- Main PCMC Head Office

Pimpri Chinchwad Municipal Corporation,

Mumbai–Pune Road, Pimpri, Pune – 411018, Maharashtra. - Property Tax Department – Bhosari Office

Near Bhosari Bus Stand, Pune – 411039. - Property Tax Department – Nigdi Office

Sector No. 25, Pradhikaran, Nigdi, Pune – 411044.

Tips to Save on PCMC Property Tax

- Pay early to get discounts offered by PCMC.

- Ensure your property details (size, type, usage) are accurate.

- Use the official portal only to avoid fraud.

Final Words

Paying PCMC property tax on time ensures that you contribute to the betterment of the city’s infrastructure and civic services. Whether you pay online or visit the PCMC property tax office, make sure your payments are timely to avoid penalties. The PCMC full form stands for Pimpri Chinchwad Municipal Corporation, and it is committed to improving facilities for residents, funded partly through property tax and the PCMC water bill.